Have you ever felt that money just seems to vanish without you even noticing where it’s gone?

I’ve struggled to work out where it all goes as well!

A few years ago, I started adjusting parts of my daily life to be more frugal. This helps you build emergency funds for rainy days and keeps you flexible when circumstances suddenly change.

Being more intentional about what comes in and goes out has made managing money and building savings much simpler.

I’d like to start with the simplest budgeting method and introduce you to minimalist saving tips that work while you’re still living as you have been.

Simple 3-Step Budgeting

Step 1: Check Your Balance

Start by looking at what’s coming in and what’s going out.

Step 2: The Budget Split

Divide your monthly budget into two categories: fixed expenses (stay similar each month; rent, insurance, phone bills, energy) and variable expenses (change monthly; food, household items, entertainment).

*Crucially, include monthly savings in the fixed expenses column.

Step 3: Start Cutting

Work out what you’re spending money on, and check which costs can be reduced right now.

Begin with the ones you can cut straight away. Start small, build confidence, and grow over time.

Money-Saving Tips for Everyday Spending

Watch Out for Household Costs

Winter means higher energy bills. The appliances that heat up or stay switched on all the time cost the most to run.

Let’s see where to save.

1. Change Light Bulbs NOW

Ditch the old fluorescent or incandescent bulbs. This is a serious quick win: LEDs can reduce energy costs by 70%. Check the energy efficiency label.

2. Energy Saving on Laundry

Keeping the temperature below 30 degrees, and using the eco timer reduces energy use. Hanging laundry up instead of using a tumble dryer costs nothing.

This also protects clothes from wearing out quickly in the wash, which means you’ll spend less on replacing them.

3. Cook With Less Energy

Use a heat-retaining pot and cook on low heat, making use of the residual heat. After you turn the hob off, keep the lid on throughout to hold the heat in. The residual heat will still cook the food, giving a healthy and tasty meal.

Less energy, minimum effort.

Beauty Swaps

4. Simplify Skincare

Keeping skincare minimal naturally saves money and time. In fact, my skin improved significantly after I dropped the complicated routines and stuck to just the basics.

Natural oats (the ones we eat) work brilliantly as a face wash and cost about £2 a year.

Argan oil does double duty for hair care (you can also mix it with castor oil) and works as a makeup remover.

5. Basic & Multi-Purpose Makeup

For makeup essentials, I keep foundation and concealer for formal occasions only. Simple and natural works best.

Multi-purpose products are brilliant here: one item can work as a highlighter, shader, and eyeshadow.

These save money, free up drawer space, and keep your routine simple.

Nifty Shopping

6. Surplus Food Takeaway

On days when cooking feels like too much, picking up local surplus food at the end of the day can be brilliant.

The app called Too Good To Go helps you get your meals all the way. Book your meal in advance and pick it up at the scheduled time.

You can get meals worth £10 for £3.30. Good value, and it helps tackle food waste too.

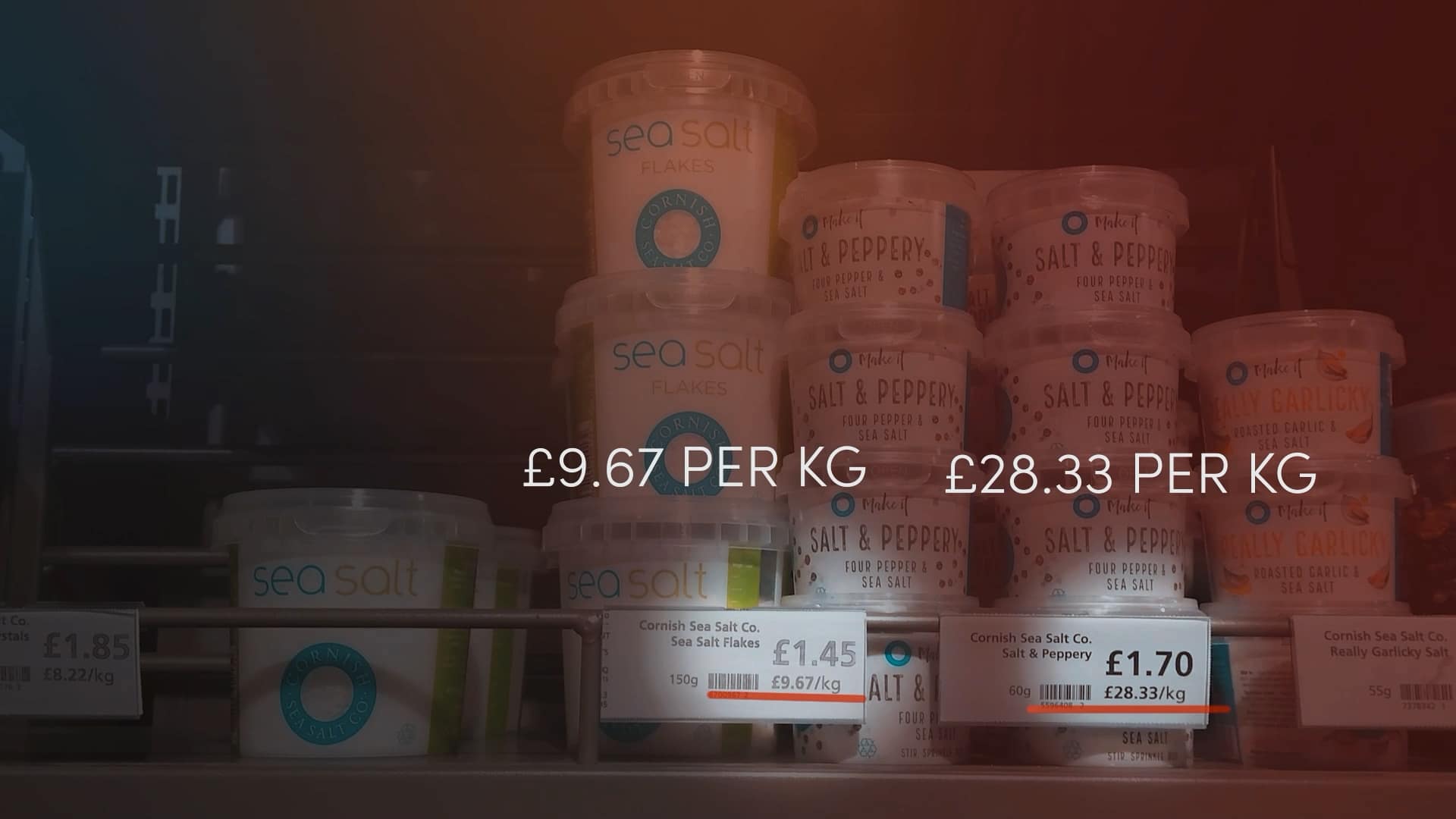

7. Beware of Bargain Tags

Low prices or big discounts can sometimes trick you when making a purchase decision.

Checking the price per unit (like price per kg)

instead of just comparing the price shows you the real value.

Keeping It Going

Focus on the bigger wins. Notice what saves you the most money and feel good about it.

Comparing your savings to someone else’s is pointless because we all have different values.

Keep it realistic.

Constantly thinking about cutting costs is draining, so take a break when you need to and just enjoy what you have right now.

You can see these tips in real-life action on YouTube, including demos and some bonus tips:

How to Save Money with Minimalism for the Cost of Living in the UK | Financial Minimalism